Quickbooks progress invoicing software#

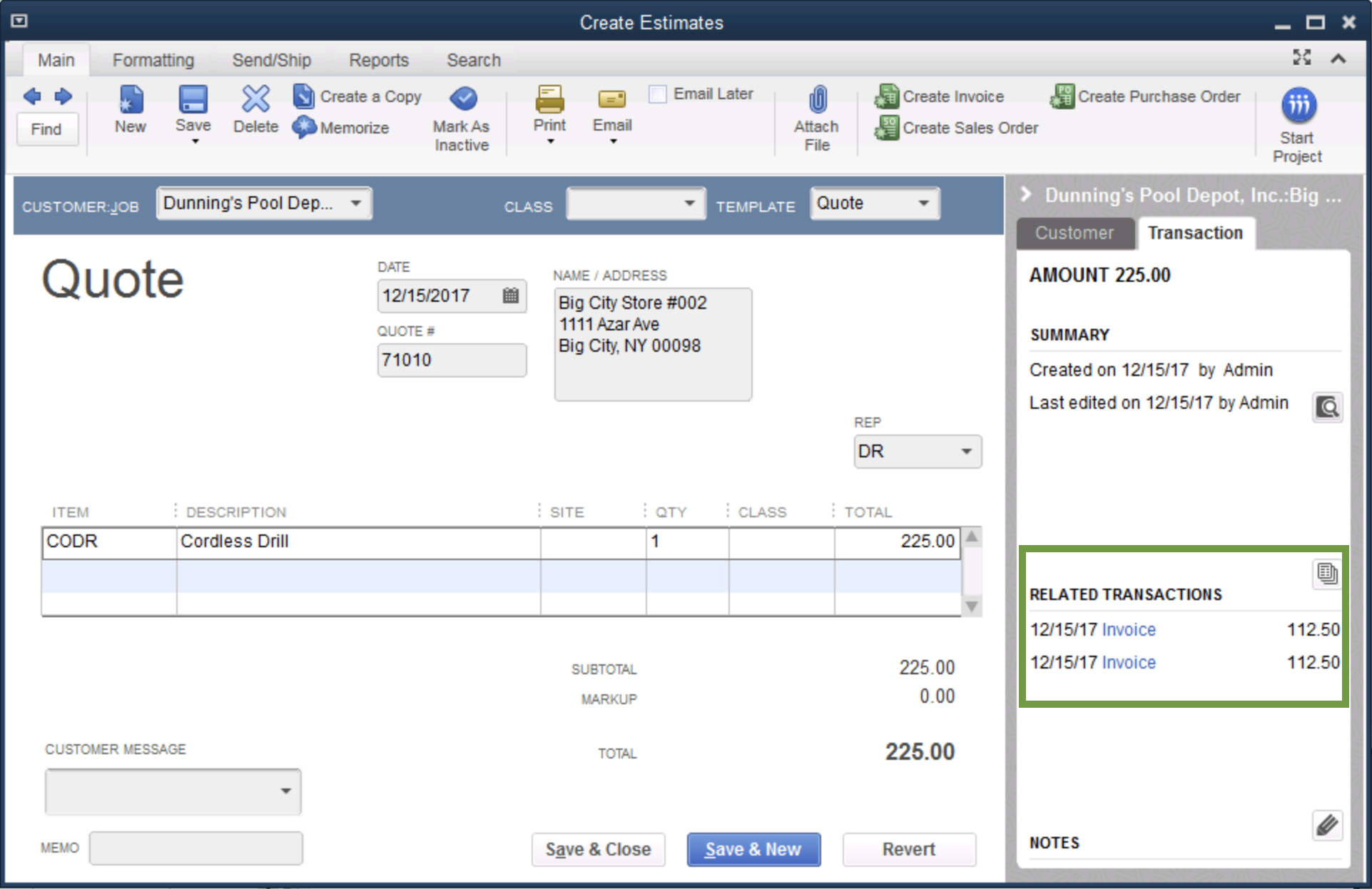

QuickBooks allows you to create and customize an invoice for clients, and then accept credit card, debit card or bank transfer payments within the invoice itself.īecause QuickBooks’ software is used for accounting at large, when a customer pays through QuickBooks Payments, the software will track these payments automatically, and the integration streamlines otherwise time-consuming accounting processes necessary for your business. For more information about our Quickbooks training courses, contact us today.Intuit QuickBooks’ invoicing capabilities are part of the larger QuickBooks ecosystem, a popular accounting software for small and large businesses. Quickbooks training will help you understand when the best time to use them is, and it will also help you keep them organized when you do use them. This report will be helpful because it will allow you to analyze your bookkeeping and billing practices to find what type of billing seems to be the most attractive to your customers.Įstimates are a great idea, however there are some cases when they’re not as beneficial for your invoicing procedures as others. On a monthly basis, you’ll be able to generate a report that is solely representative of your progress invoices. As you begin using estimates as a regular part of your invoicing routine, Quickbooks’ reporting feature will help you manage them. Otherwise, they can become very confusing. This will make the necessary changes so that you don’t have to change the entire estimate itself.Īlthough estimates are very helpful for both you and your customer, it’s important to keep up with them. To accommodate their requests, simply create a purchase order from the original estimate. There are bound to be changes, such as your customer adding an item or deleting an item from the original order.

Estimates are a beneficial Quickbooks feature because you can customize your billing based on the agreements you make with your customers.

Creating an estimate also helps them understand the bigger picture.

QuickBooks makes progress invoicing easy, giving you the freedom to accommodate your customers’ requests by billing them in segments, rather than all at once.Įstimates are a great way to inform your customers about the total cost of a job, while allowing you break down the total into payments. Rather than paying a lump sum for your services, many of them might prefer to pay a percentage at a time. Many of your customers are probably still being a little bit careful with the money they spend, even though the economy seems to be picking up.

0 kommentar(er)

0 kommentar(er)